Angelo Mozilo - From Humble Beginnings To Big Decisions

The story of Angelo Mozilo is, in a way, a very vivid picture of the American experience, taking us from modest beginnings to the very top of the financial world, and then through a truly difficult period. His path, you see, touched the lives of so many people, offering a vision of homeownership that felt within reach for many, yet it also became linked to a time of great trouble for the country's economy. It's a tale that prompts us to think about ambition, about the way big businesses operate, and about the sometimes very unexpected consequences that can come from trying to help a lot of people achieve what they want most.

For quite some time, Angelo Mozilo was seen by many as a person who understood what people hoped for, someone who helped make the dream of owning a house a reality for countless families. He certainly built something truly large, a company that grew to be a significant presence in the mortgage business. But, as things unfolded, his name also became connected with a very painful part of recent financial history, a time when many people faced serious challenges with their homes and their livelihoods. It is, perhaps, a story that shows how closely personal drive can connect with broader societal changes.

This account explores the life and influence of Angelo Mozilo, looking at the journey he took from a childhood in New York to becoming a powerful figure in finance, and then, quite sadly, the face of a widespread financial difficulty. We will consider the kind of company he created, the choices made along the way, and the lasting effects of those choices on many individuals and on the economy as a whole. It’s a narrative that, in some respects, reminds us how intertwined the paths of individuals can become with the larger forces at play in the world.

Table of Contents

- Biography of Angelo Mozilo

- From Humble Roots to Financial Heights

- How Did Angelo Mozilo Build Countrywide?

- The American Dream and Its Unexpected Turn

- What Happened to Angelo Mozilo's Company?

- The Aftermath - What Was Angelo Mozilo's Role?

- What Lessons Can We Learn from Angelo Mozilo's Story?

- A Look at Angelo Mozilo's Personal Life

Biography of Angelo Mozilo

Angelo Mozilo, a person whose life spanned several decades and saw some very big changes in the financial landscape, began his journey in New York in 1939. His early life was quite different from the grand scale of his later career. His father, as a matter of fact, worked as a butcher in the Bronx, and the family lived in a rather small two-room space. This humble start, you could say, paints a picture of a childhood that was grounded in everyday life, far from the world of high finance he would eventually shape. It shows, too, that even those who rise to great prominence often come from very ordinary beginnings, building their path step by step.

Like many people who came to America seeking new opportunities, Angelo's family had a history of traveling across oceans to find a better life. The text mentions that, like most emigrants, Angelo himself traveled in what was called "third class," or "steerage." This part of the ship was typically on a lower deck, below the water line, and it was set up in a way that resembled a dormitory. There were specific areas designated for families, for women, and so on. This detail, you know, gives us a glimpse into the conditions many people endured to reach new shores, and it suggests a deep connection to the immigrant experience that shaped a whole generation of Americans. It is a reminder of the sheer determination that often propels individuals forward.

From these modest roots, Angelo Mozilo eventually became a cofounder, chairman, and chief executive officer of Countrywide Financial Corporation. This progression from a simple family life to leading a major financial institution is, in some respects, a very classic American narrative of striving and achievement. His story shows how someone from a relatively unprivileged background could, through ambition and hard work, reach a position of considerable influence and wealth. It is a powerful example of how opportunities, if seized, can lead to very significant outcomes, sometimes for better, sometimes for worse, as we will see. His life, basically, unfolded in a way that few could have predicted from his beginnings.

Personal Details and Bio Data of Angelo Mozilo

| Detail | Information |

|---|---|

| Full Name | Angelo Mozilo |

| Born | 1939, New York |

| Died | 2023 (at 84 years old) |

| Spouse | Phyllis Mozilo (married 1961, married over 50 years until her passing in 2017) |

| Father's Occupation | Butcher in the Bronx |

| Key Role | Cofounder, Chairman, and Chief Executive Officer, Countrywide Financial Corporation |

| Legacy Connection | Trustee emeritus and father of current board chair, Christy Larsen (BA ’88) |

From Humble Roots to Financial Heights

Angelo Mozilo's journey from a childhood in the Bronx, where his father worked as a butcher and the family lived in a two-room dwelling, to becoming a very prominent figure in the financial world is a striking one. This early experience of limited means, one might argue, could have instilled in him a deep understanding of what it meant for people to strive for something more, particularly the dream of owning a home. It's almost as if his own background might have shaped his desire to make that dream accessible to a wider range of people. The path he took from those modest beginnings was, in a way, a very determined one, leading him to build something truly vast.

The transition from a simple family life to the leadership of a major financial institution like Countrywide Financial Corporation speaks volumes about his drive and vision. He was, in fact, the cofounder, chairman, and chief executive officer, roles that demand a great deal of skill and foresight. This progression suggests a person who was not only ambitious but also possessed the ability to organize and lead a large operation. The sheer scale of what he built, transforming Countrywide into the country’s largest mortgage lender, is, you know, a testament to his considerable business acumen and his capacity to expand a company very quickly.

His story, therefore, is not just about a person getting rich; it is also about the creation of a vast enterprise that profoundly affected the housing market across the United States. The text tells us that he got rich selling the American dream, which implies that his business model was built on the idea of helping people achieve a significant life goal. This aspect of his career, providing access to homeownership, was initially seen by many as a very positive contribution. It shows how a person can, in fact, become a central figure in a nation's economy, shaping the opportunities available to many ordinary citizens. This rise to such a position of influence is, in some respects, quite remarkable.

How Did Angelo Mozilo Build Countrywide?

Angelo Mozilo, with his characteristic brash approach, built Countrywide Financial into what became the nation’s largest home mortgage firm. This was not an overnight success; it involved years of strategic growth and, apparently, a very keen understanding of the mortgage market. The text points out that he "propelled" the company, which suggests a forceful and very active leadership style. He didn't just manage; he drove the company forward with considerable energy, making it a dominant player in the field. This kind of growth, you know, often requires a willingness to take risks and to push boundaries in a significant way.

The company's expansion meant reaching out to a very wide range of people, offering loans that made homeownership possible for many who might not have qualified through traditional channels. In some respects, this was seen as a very positive step, broadening access to what many consider a fundamental part of the American dream. The sheer volume of loans Countrywide handled was immense, allowing it to become the largest US mortgage lender during the housing boom. This scale of operation indicates a very sophisticated system for processing and distributing loans across the country, a system that Angelo Mozilo was instrumental in putting together and overseeing. It's quite a feat, actually, to build something that big.

However, the way Countrywide grew also involved taking on what were described as "increasingly risky loans." This phrase suggests a shift in the company's lending practices over time, moving towards a model that, while expanding reach, also brought with it greater potential for trouble. The decisions made during this period of growth, therefore, were not without their difficulties, and they would later become a central point of discussion when the housing market faced severe challenges. The strategy, while successful in building a large company, also laid the groundwork for the issues that would eventually cause its downfall. It is, basically, a complex picture of rapid expansion.

The American Dream and Its Unexpected Turn

Angelo Mozilo, as the text very clearly states, got rich selling the American dream. This idea, the dream of owning a home, is deeply ingrained in the country's culture, representing stability, a place to raise a family, and a sense of belonging. Countrywide Financial, under Mozilo’s guidance, made it their business to help people achieve this dream, offering financial products that opened doors for many who might have felt left out of the housing market. It was, in a way, a very powerful promise, and for a time, it seemed to be working for a lot of people. The company's growth was fueled by this widespread desire for homeownership, making it a truly central player in the lives of many.

Yet, the story takes a very difficult turn, as Angelo Mozilo then "became the face of America's mortgage nightmare." This phrase captures the profound shift in public perception and the severe consequences that followed. The very mechanisms that made homeownership accessible to so many – the "increasingly risky loans" – eventually contributed to a widespread financial crisis. The dream, for a considerable number of people, turned into a very painful reality of lost homes and significant financial hardship. This reversal is, you know, a very stark reminder of how quickly circumstances can change and how large-scale financial decisions can have deeply personal impacts on individuals and families.

The fallout from the housing bust, which saw Countrywide buckle and effectively collapse, left many homeowners in very difficult situations. The text directly mentions "homeowners that are living in shelter with their families and job that were lost." This stark detail illustrates the human cost of the crisis, showing that the economic downturn was not just about numbers on a ledger; it was about real people facing very challenging circumstances. The contrast between the initial promise of the American dream and the later reality of widespread distress is, perhaps, the most poignant part of Angelo Mozilo’s story, highlighting the very real human consequences of financial decisions made at the highest levels. It is, in some respects, a very sobering thought.

What Happened to Angelo Mozilo's Company?

Countrywide Financial Corp, the mortgage giant that Angelo Mozilo built into the largest US lender, eventually faced a very dramatic downfall. The company, which had been a symbol of widespread access to homeownership during the housing boom, saw its fortunes reverse completely. The text indicates that it was "propelled" to become the largest lender, only "to see the company crash in the 2008 financial crisis." This collapse was not a slow decline but a very sudden and severe event that sent shockwaves through the financial world and, more importantly, through the lives of countless homeowners. It's a very clear example of how quickly a powerful enterprise can unravel when market conditions shift dramatically.

The core issue, as the text suggests, was the company's reliance on "increasingly risky loans." While these loans initially helped Countrywide expand its reach and market share, they also made the company very vulnerable when the housing market began to falter. When property values started to drop and many borrowers found themselves unable to make their payments, the sheer volume of these loans became a massive liability. The brash chief executive, Angelo Mozilo, who had steered the company to such heights, then watched as his creation "buckle and effectively collapse." This must have been, you know, a very difficult experience for someone who had poured so much into building the firm.

The collapse of Countrywide was a significant event within the broader context of the 2008 financial crisis. Its failure was not an isolated incident but a key part of a larger systemic problem that affected the entire country. The company's practices, particularly its aggressive lending, became a focal point in discussions about what went wrong in the housing market. The firm's fall from grace was, basically, a very public and very painful reminder of the dangers inherent in financial systems when risks are not properly managed. It is, in some respects, a very stark illustration of how quickly market conditions can change, impacting even the largest of businesses.

The Aftermath - What Was Angelo Mozilo's Role?

Following the crash of Countrywide Financial in the 2008 financial crisis, Angelo Mozilo, as the former chief executive, found himself at the center of considerable scrutiny and legal action. His position as a "key player in the subprime mortgage meltdown" meant that his decisions and the company's practices were examined in great detail. The aftermath was not just about the company's collapse but also about the accountability of those who led it. It's a situation where, you know, the consequences of business decisions extend far beyond the boardroom, touching the lives of many people and attracting the attention of regulatory bodies.

The Securities and Exchange Commission (SEC) took very direct action against Angelo Mozilo and other former executives. In 2009, the SEC "charged former Countrywide Financial CEO Angelo Mozilo and two other former executives with securities fraud." This was a very serious accusation, indicating that the authorities believed there were issues beyond just poor business judgment. These charges brought a legal dimension to the public's understanding of what had transpired, suggesting that there were potentially deliberate actions that contributed to the financial difficulties. This kind of legal proceeding is, in some respects, a very public way of seeking answers and assigning responsibility.

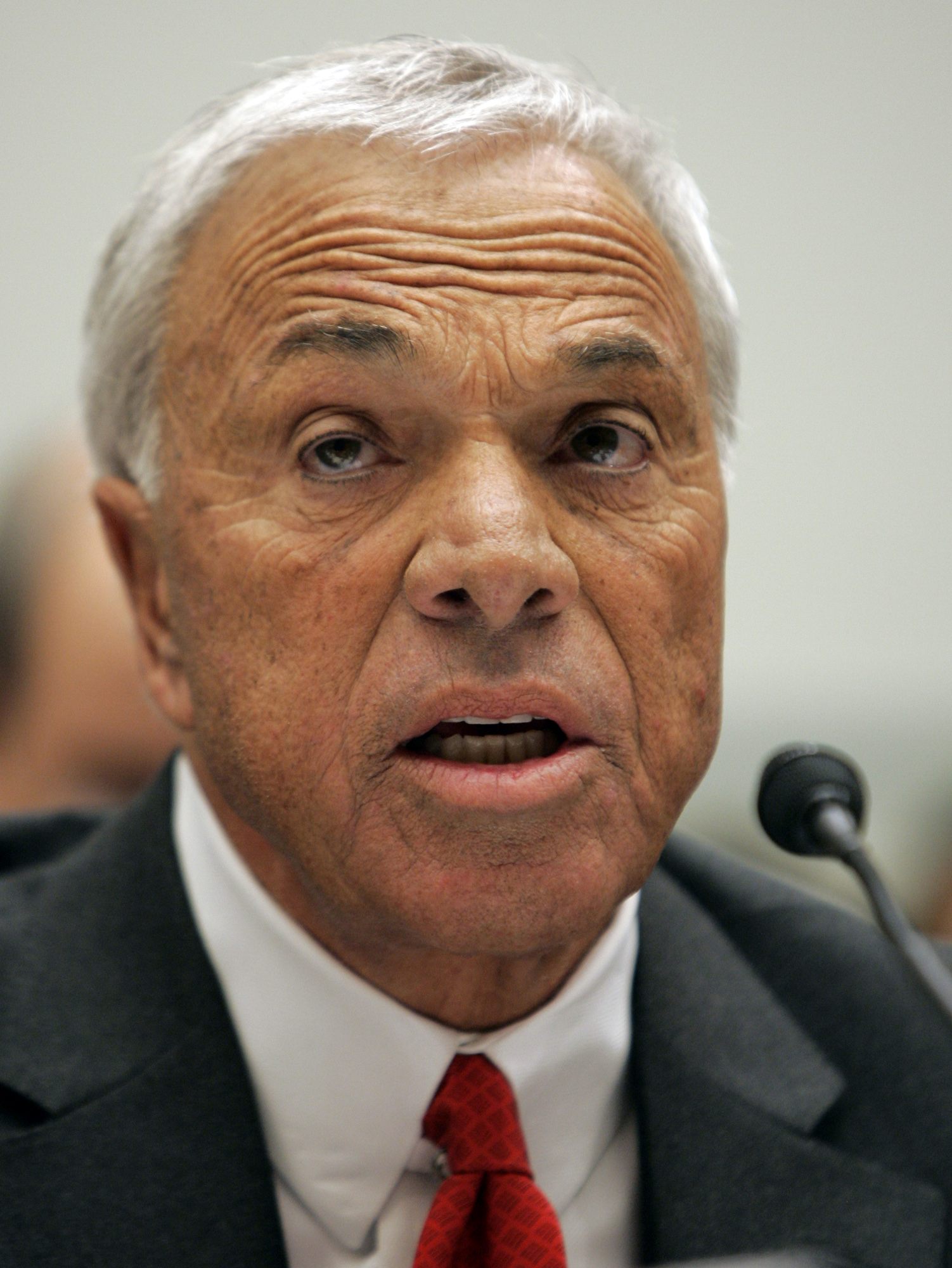

The legal consequences for Angelo Mozilo were significant. In 2010, the SEC announced that he "will pay a record $22.5 million." This substantial payment was a very clear signal of the financial penalties associated with the issues at Countrywide. He also testified at a hearing of the House Oversight and Government Reform Committee, specifically addressing matters like severance packages. These public appearances and financial settlements were part of the broader effort to understand and respond to the crisis. It shows, too, that even those at the very top of large corporations can face very serious repercussions when things go wrong on a grand scale. The scrutiny he faced was, basically, very intense.

What Lessons Can We Learn from Angelo Mozilo's Story?

The story of Angelo Mozilo and Countrywide Financial, in some respects, offers several points for reflection, particularly concerning the balance between ambition and caution in the financial world. His success in building a vast mortgage lending operation shows the power of vision and drive, demonstrating how a person can, you know, create something truly significant that touches the lives of millions. However, the subsequent collapse of the company and the widespread difficulties that followed highlight the very real dangers that can arise when growth is pursued without sufficient attention to underlying risks. It's a very clear reminder that even the most impressive achievements can have very difficult downsides.

One might consider how the pursuit of making the "American dream" accessible to more people, while a noble goal in itself, can become problematic if the means to achieve it involve taking on too much risk. The text points to "increasingly risky loans" as a contributing factor to the downfall. This suggests that good intentions, if not paired with careful planning and strong safeguards, can lead to very unintended and very painful outcomes for many individuals. It raises questions, basically, about the responsibilities that come with wielding great financial power and the need for those in leadership positions to consider the broader societal impacts of their decisions, not just the immediate business gains. It's a very complex interplay of factors.

Furthermore, Angelo Mozilo’s story, with the legal actions and financial penalties that followed, serves as a very stark illustration of accountability in the business world. When a company's actions lead to widespread hardship, those at the helm can and often do face very serious consequences. This aspect of his story, you know, reinforces the idea that leadership comes with a very significant burden of responsibility, not just to shareholders but also to the wider public and to the integrity of the financial system itself. It’s a narrative that, in some respects, encourages a deeper look at how financial innovation can be managed in a way that truly benefits everyone, rather than leading to widespread difficulties for families who simply want to own a home.

A Look at Angelo Mozilo's Personal Life

Beyond the headlines of financial success and controversy, Angelo Mozilo's personal life, as the text reveals, was marked by a very enduring relationship with his wife, Phyllis. They met when they were still teenagers, a detail that paints a picture of a very early connection, one that began long before he became a prominent figure in the financial world. The two married in 1961, and their union lasted for more than 50 years. This length of time together, you know, speaks to a deep and lasting bond, a very significant personal foundation amidst the very public and often turbulent nature of his career. It's quite a testament to their relationship.

Phyllis Mozilo passed away in 2017, and Angelo's own "peaceful passing" occurred in 2023, at the age of 84. The fact that their marriage spanned over five decades, ending only with Phyllis's death, highlights a very consistent and stable aspect of his life. This personal detail offers a glimpse into the man behind the corporate title, suggesting a private world of family and companionship that ran parallel to his very demanding public role. It reminds us, too, that even those who become central figures in major financial events have personal lives, relationships, and experiences that shape them outside of their professional identities. This long-standing marriage is, in some respects, a very humanizing detail in a story often dominated by numbers and economic events.

The text also mentions a connection to Angelo State, noting that Angelo Mozilo was a "trustee emeritus and father of current board chair, Christy Larsen (BA ’88)." This detail points to a continued family legacy and a connection to educational institutions, suggesting that even after his retirement from Countrywide, he maintained ties to other organizations. This involvement, through his daughter, shows a continuation of influence and perhaps a different kind of contribution to the community. It's a reminder that a person's life is often a tapestry of various roles and relationships, extending beyond a single defining career. His passing, like anyone's, marked the end of a very full and, in some ways, quite extraordinary life, filled with both very public triumphs and very difficult challenges.

Former Countrywide CEO Angelo Mozilo says crisis wasn't his fault

Phyllis and Angelo Mozilo

Angelo Mozilo - Alchetron, The Free Social Encyclopedia