Bill- Simplifying Your Financial Connections

In the world of personal and business finances, the word "bill" often brings to mind a piece of paper or a digital message asking for money. It's that familiar statement you get after buying something or using a service, letting you know what you owe. For businesses, handling these incoming and outgoing requests for funds is, well, pretty much a constant activity. It's about keeping track of what's due to others and what others owe to you, which can feel like a lot to manage.

For many, the idea of dealing with all those payments and requests for payment can seem a bit overwhelming. You might find yourself spending quite a bit of time just sorting through everything, making sure payments go out on time, and chasing up money that's owed to your own company. It's a vital part of keeping things running smoothly, but it can certainly take up a lot of precious moments that you could otherwise spend on other important parts of your work or your life, you know?

Luckily, there are ways to make this whole process a lot less taxing, whether you are a small business owner, part of a bigger accounting group, or just someone trying to keep their own household finances in order. We're going to talk about how the concept of a "bill" fits into all these different situations and, actually, how some smart tools can help you handle them with a lot more ease and less fuss. It's about taking the stress out of those money requests and making sure your financial connections are clear and simple.

Table of Contents

- What Does a Bill Mean for You?

- How Can Technology Make Bill Payments Easier?

- Where Can You Find Support for Your Bill Needs?

- Is There More to the Word "Bill" Than Just Payments?

What Does a Bill Mean for You?

When you hear the word "bill," what comes to mind first? For most people, it's that written piece of paper, or maybe an email, that tells you how much money you need to pay for something you've received. It could be for the power you've used, the internet service that keeps you connected, or maybe even the groceries you picked up last week. It's a formal way of saying, "Here's what you owe for the goods or services we gave you." This is, you know, a pretty common part of everyday life, whether you are running a household or a company.

Sometimes, people find themselves in a tight spot where they just can't quite get together the funds to cover all these requests for money. That's a feeling many can relate to, actually. It highlights how important it is to have a good handle on your finances, both personally and for any kind of business you might be running. Keeping track of all these different financial requests is, in some respects, a crucial part of staying financially healthy.

The idea of a bill is really about accountability. It's a record, a way to make sure that transactions are clear and that everyone knows what's expected. For businesses, this is, well, even more important. They have to deal with so many of these requests coming in from suppliers and so many going out to customers. It’s a constant flow of financial messages, and managing that flow is key to their continued existence.

Understanding the Basic Bill

Let's think a little more about what that basic bill truly represents. It's not just a request for money; it's a summary of a transaction. It details what was provided, when it was provided, and the cost associated with it. This clear communication helps avoid confusion and makes sure both sides of a transaction are on the same page. For a company, getting these details right on every bill they send out is, you know, super important for their reputation and for getting paid on time.

Similarly, when a company receives a bill, they need to check it over carefully. Is it for services they actually received? Is the amount correct? This checking process, often called "accounts payable," is a big part of keeping a business financially sound. It's about making sure you're only paying for what you truly owe and that the numbers all add up. It’s a bit like making sure your shopping receipt is right before you leave the store, but on a much larger and more involved scale, actually.

The core message here is that a bill, in its most basic form, is a fundamental piece of financial communication. It’s the handshake, more or less, between two parties about money owed for something exchanged. Understanding this simple idea is the starting point for handling all the more involved financial tasks that come along with running a business or even just managing your own household budget. It's the foundation, you could say.

How Can Technology Make Bill Payments Easier?

In the past, managing all those bills meant a lot of paper, a lot of filing, and a lot of manual work. Think about it: writing out checks, putting them in envelopes, heading to the post office, or even just keeping stacks of invoices organized. It was, well, quite the chore, especially for businesses with many transactions. But now, with the amazing advancements in technology, handling payments and requests for money has become, you know, so much simpler and more efficient.

Today, there are tools that can take away a lot of that heavy lifting. They can, for instance, handle the routine tasks of keeping financial records, making it easier for businesses to pay what they owe to others, and even giving them new ways to offer services that help clients manage their own spending. This shift from paper and manual effort to digital systems is, really, a huge step forward for anyone dealing with money matters. It’s about making the process smoother and less prone to mistakes.

These digital helpers mean you can often get things done from pretty much anywhere, at any time. The idea of being tied to an office desk to manage your finances is, in a way, becoming a thing of the past. This flexibility is a really big deal for busy people and growing companies. It means you can focus on the bigger picture, rather than getting bogged down in the daily grind of financial paperwork.

The Bill Application- Your Mobile Helper

One of the best examples of how technology helps is through dedicated applications, like the Bill app. This kind of tool lets you take care of your business's behind-the-scenes financial work right from your mobile device. Think about that for a second: you can be out and about, maybe meeting with clients or traveling, and still be able to keep an eye on your financial flow. It’s, in some respects, like having your office in your pocket, ready whenever you need it.

Being able to manage things like approvals for payments or checking on incoming funds, around the clock, is a very useful feature. This kind of access, available for both Apple and Android devices, means you are never really out of touch with your company's money matters. It gives you a sense of control and peace of mind, knowing you can respond quickly to anything that comes up, without having to wait until you are back at a traditional workspace.

So, whether you are trying to get money paid out to your suppliers or making sure you receive payments from your own customers, a mobile tool like the Bill application can make the whole process a lot less complicated. It’s about putting the ability to manage your finances right where you need it, when you need it, making your business operations, you know, more adaptable and responsive. It truly simplifies what used to be a very involved set of tasks.

Getting Your Business Bills Under Control

Beyond just mobile access, these kinds of digital systems help businesses handle their entire financial workflow. They make it easier to create requests for payment, get them approved by the right people, and then send out the money. It’s a connected way of doing things, so each step flows smoothly into the next, which is, actually, pretty neat. This kind of system can also link up with your existing accounting software, making sure all your financial records are consistent and up to date.

Imagine being able to get a better handle on your company's cash flow. With features that help you keep a closer eye on your spending and give you more control over your credit, you can make smarter choices about your money. This means you can keep more cash available for what your business needs most, and that, you know, can make a real difference in how well your company performs. It's about having the right information at your fingertips to make smart financial moves.

These tools aren't just for small companies either; they offer different levels of service and pricing to fit businesses and accounting groups of all different sizes. Whether you are a solo entrepreneur or a large firm with many clients, there's a way to get your accounts payable, accounts receivable, and overall spending management working better for you. Millions of companies and accounting groups, as a matter of fact, rely on these kinds of digital helpers to keep their financial operations running smoothly. It's a pretty clear sign that these systems are making a real positive impact.

Where Can You Find Support for Your Bill Needs?

Even with the simplest systems, questions or little bumps in the road can pop up. When you are dealing with your money, knowing where to get help quickly is, you know, super important. For things like the Bill platform, there are clear ways to get the assistance you might need, whether it's about logging in, understanding a certain feature, or just getting general advice. Having easy access to support means you don't have to feel lost or frustrated when something isn't quite clear.

For instance, if you are having trouble getting into your account, or if you need some help but don't yet have a Bill account, there are specific places to go for guidance. This means that even before you are a regular user, you can get your questions answered and feel more comfortable about how things work. It's about making sure that anyone who needs a bit of help can find it, no matter their current connection to the service.

The fastest way to get your questions answered is typically by visiting a dedicated help area. This kind of online resource is packed with useful information, answers to common questions, and guides on how to do different things within the system. It’s like a big library of knowledge, available whenever you need it, so you can often find the answers you're looking for without having to wait to speak to someone directly.

Connecting with Bill Assistance

Sometimes, you might need to talk to a real person, and that's totally understandable. For services like Bill, there are often live support options available. You can usually find their operating hours listed, so you know when you can connect with someone who can give you direct help. This kind of personal assistance is, you know, very helpful when you have a specific problem that a general guide just can't quite cover.

For example, the Bill service offers live support for many hours during the week and even on weekends, except for holidays. This wide availability means that most businesses, regardless of their own operating hours, can find a time to get the help they need. Whether it's early in the morning or later in the afternoon, there's a good chance someone will be there to chat with you or help you sort things out, which is, honestly, a huge relief for busy business owners.

Accessing this help is usually pretty straightforward. You might find a "help center" option in the main menu of the service, or a "support" link somewhere on the website. These links are there to guide you directly to the resources you need, whether it's an article to read or a way to start a conversation with a support person. It's all about making sure you feel supported as you use the system to manage your important financial requests and payments.

Is There More to the Word "Bill" Than Just Payments?

While we've spent a lot of time talking about the "bill" as a request for money owed, or as a helpful application for managing those requests, the word itself has other meanings too. It's a word that pops up in different contexts, sometimes referring to official documents or even parts of a bird. For our purposes, it's interesting to see how the idea of a "bill" can also relate to broader economic activities, especially when we think about how businesses grow and how investments are made.

Sometimes, a "bill" can refer to a proposed law or piece of legislation. In that sense, a "bill" can have a huge impact on how businesses operate. For example, a recent "bill" might have changed how companies can write off their investments, meaning they can deduct the full cost of certain purchases right away. This kind of change, as a matter of fact, can really help companies expand, hire more people, and even offer better wages. It’s about creating an environment where businesses can thrive and grow.

So, a "bill" in this context isn't about paying for a service; it's about creating rules that encourage economic activity and help smaller businesses, often called "main street" businesses, to get bigger and stronger. It's a very different meaning from the usual financial request, but it shows how one word can have many different, yet still very important, implications in the world around us.

The "Bill" in Business Expansion and Investment

Thinking about the word "bill" in terms of investments, you might come across "Bill Holdings, Inc." This is a company that you can actually invest in, and like any company that's traded publicly, its stock has a price that goes up and down. People who are interested in buying and selling parts of companies will look at things like the latest stock price, how it's changed over time, and any news related to the company. This kind of information is, you know, really important for making smart choices about where to put your money.

So, when you see "Bill" in the context of stock trading or investing, it’s referring to a specific company that helps other businesses with their financial processes. It’s a bit of a twist on the word, but it highlights how the company that helps manage your "bills" can itself be a part of the bigger financial world of investments. It’s a very different kind of "bill" than the one you get for your utilities, that's for sure.

In essence, the word "bill" is quite versatile. It can mean a statement of money owed, a helpful digital tool to manage those statements, a proposed law that affects businesses, or even the name of a company you might invest in. Each meaning, in its own way, touches upon how money moves, how businesses operate, and how the larger economy functions. It's a simple word, but it carries a lot of different, and often very important, meanings depending on the context.

Bill Gates Fast Facts - CNN

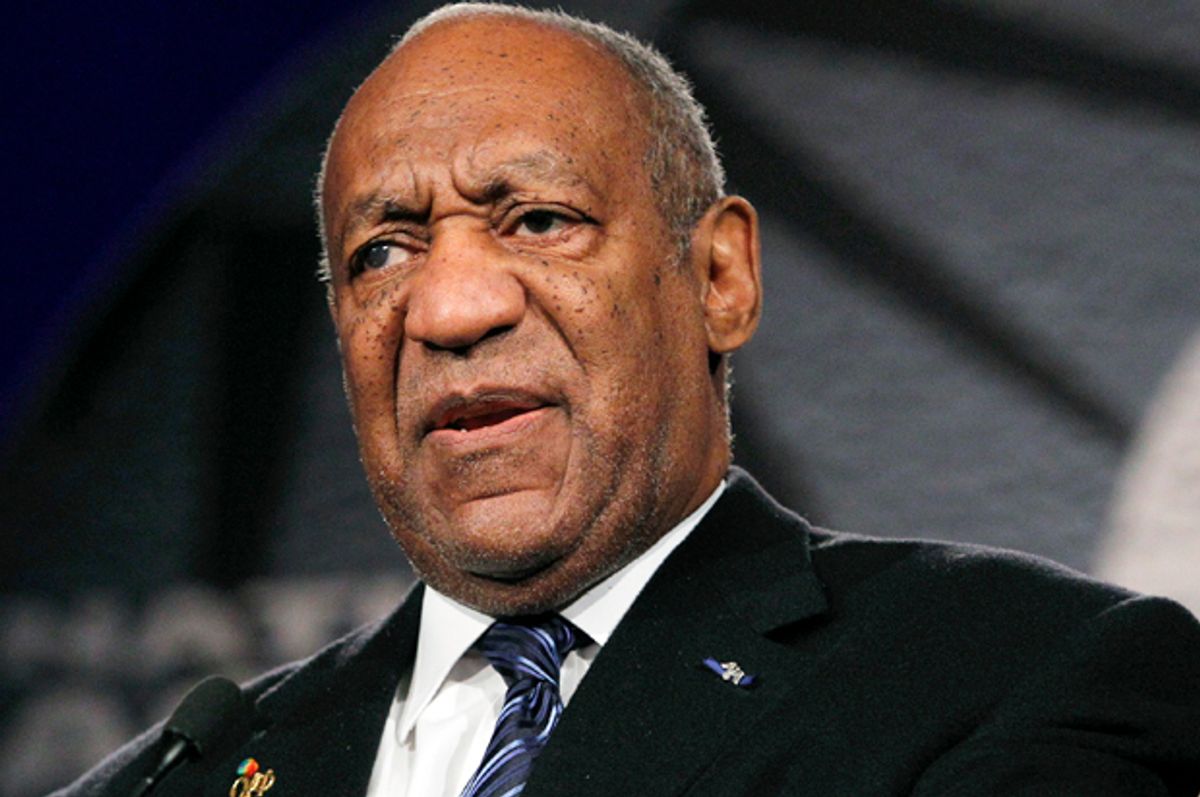

Bill Cosby's media inferno: On journalists reporting justice -- and

Bill Cosby's PR team now says tour isn't about sexual assault | Salon.com