Anne Dias - A Look At Her Professional Path

It's really quite interesting to consider the paths people take in the world of finance, and Anne Dias is, like, certainly someone whose journey captures a lot of attention. She’s been a significant figure, you know, building something substantial from the ground up. Her story, in some respects, gives us a chance to see how a vision can really come to life in the investment space.

So, we're going to take a moment to look at her work, particularly with Aragon Global Management, which is a firm she started. It’s a pretty compelling story of how a company grows and changes over time, especially when you think about the kind of capital it began with. It just goes to show, doesn't it, how early support can make a huge difference for a new venture, basically.

This discussion will also touch upon her standing in the financial community, which, you know, is a pretty big deal. We'll also explore some of the more public parts of her personal life, as they've been mentioned in various places. It's, as a matter of fact, a comprehensive picture of someone who has made quite an impact in the investment world, both professionally and, in some ways, personally.

Table of Contents

- A Glimpse into Anne Dias's Life and Career

- What is Aragon Global Management, and How Did Anne Dias Shape It?

- How Did Anne Dias Become a Notable Figure in Finance?

- What Was Anne Dias's Role at Aragon Global?

- What About Anne Dias's Recent Activities?

- Were There Personal Aspects of Anne Dias's Life That Became Public?

- What Kind of Investment Focus Did Anne Dias's Firm Have?

- How Did Anne Dias's Firm Get Started?

A Glimpse into Anne Dias's Life and Career

Anne Dias, you know, has quite a story when it comes to her professional life. She is, as a matter of fact, widely known as the founder and chief executive officer of Aragon Global Management. This is an investment business that, apparently, has been quite active in buying and selling company shares across the globe. Her connection to this firm is really what she's most recognized for in the finance community. She's been at the helm, directing its path and shaping its focus over many years, which is, well, pretty impressive if you ask me. It just goes to show, doesn't it, how much one person can influence an entire business's direction and success, especially in a field like global investments.

Her work at Aragon Global Management, you know, has certainly put her in a position where many people in the financial community recognize her contributions. From what's been shared, it's clear she's been a driving force behind the company's activities, particularly its approach to global equities. This kind of leadership requires a pretty deep understanding of markets and, you know, a clear vision for where to put money. She’s, quite literally, been the one guiding the ship, making choices that affect the firm’s standing and its ability to make good on its investment strategies. It's, like, a big responsibility, obviously, and one she seems to have taken on with considerable dedication, basically.

Personal Details: Anne Dias

When we talk about Anne Dias, it's worth noting some of the personal aspects that have, you know, been shared publicly, though our primary focus is on her professional journey. It's just a little bit of background that helps complete the picture, in a way. For instance, at one point, she was 51 years old when her firm, Aragon Global Management, opened its doors to outside investors for the first time, which is, you know, a pretty significant step for a private investment office. This detail gives us a bit of a timeline for her career milestones. She was also, apparently, once married to Kenneth Griffin, who is also a notable figure in the financial world. This connection, of course, brought some of her personal life into the public eye, especially during certain times.

There were, you know, some reports about her family life, too. For example, court documents mentioned that she had children, who were, at one point, aged 6, 4, and 2. These details, while personal, were brought up in public records, specifically related to discussions about their home and family arrangements. It was, like, a pretty public situation, and it just shows how even private lives can sometimes become part of the general conversation when people are well-known. So, while we're mostly talking about her work, these bits of personal information, you know, help round out the general understanding of Anne Dias as a person, rather than just a name on a business card, if that makes sense.

| Detail | Information |

|---|---|

| Age (at a specific career milestone) | 51 years old (when Aragon Global Management opened to outside investors for the first time) |

| Spouse (former) | Kenneth Griffin |

| Children's Ages (at a specific time) | 6, 4, and 2 years old |

| Professional Community Presence | LinkedIn (profile on a professional community of 1 billion) |

What is Aragon Global Management, and How Did Anne Dias Shape It?

Aragon Global Management is, you know, the business that Anne Dias started back in 2001. It’s, in a way, her brainchild, and it really took off with some initial money, or "seed capital" as they call it, from Julian Robertson of Tiger Management. This kind of backing, you know, from a well-known figure, is a pretty big deal for a new company. It, like, gives it a lot of credibility right from the start, and it probably helped Aragon get its footing in the competitive world of investments. So, that early support was, obviously, a very important part of the firm’s beginnings, basically setting the stage for what was to come.

Over time, Aragon, apparently, grew quite a bit and became, you know, one of the more significant and easily recognized asset management firms. This growth wasn't just by chance; it was, obviously, a result of the strategies and decisions made by Anne Dias and her team. The firm's ability to gain such recognition suggests that its approach to investments was, like, quite effective and, you know, perhaps even innovative for its time. It’s a testament to the hard work and, you know, the vision that went into building it from a startup into something much larger and more prominent in the finance community. It's, well, a pretty good example of sustained success, you know.

Then, just last year, when Anne Dias was 51, Aragon Global Management, for the very first time, started taking money from outside investors. Before this, it was more of a private investment office, handling its own funds. This change is, you know, a pretty big step for any firm, as it means opening up to a broader group of people and their capital. It also suggests a new phase of growth or, perhaps, a shift in strategy for the company. It’s, actually, quite a significant milestone for a business that had, you know, operated in a more closed way for so long. This decision, in a way, marked a new chapter for both Anne Dias and Aragon Global, really.

The firm, you know, has a specific focus when it comes to where it puts its money. Aragon Global Management, under Anne Dias's guidance, is, apparently, very active in global equities, which just means shares of companies all over the world. More specifically, they tend to look at companies in certain sectors, like technology, consumer goods, and financial services. This kind of specialized approach, you know, allows them to build expertise in particular areas. It's, well, a pretty common strategy for investment firms to pick a few areas and become really good at them, rather than trying to do everything. So, you know, it makes sense that they would have these particular areas of interest.

Beyond that, Aragon is, actually, involved in Europe’s digital ecosystem, which includes both public companies and private ones. This means they're not just looking at big, well-known companies on stock exchanges, but also at newer, perhaps smaller, tech businesses that aren't yet publicly traded. It’s, like, a way to get in on the ground floor with potentially fast-growing companies. This focus on the digital space, especially in Europe, shows that Anne Dias and her team are, you know, keeping an eye on where the economy is headed, particularly with how technology is changing things. It's, well, a pretty forward-looking approach, you know, to investment, really.

How Did Anne Dias Become a Notable Figure in Finance?

Anne Dias is, you know, often called a "hedge fund veteran," which pretty much means she has a lot of experience in that specific part of the finance world. This title isn't given lightly; it suggests years of work, dealing with market ups and downs, and making some pretty big investment decisions. It’s, like, a sign of her long-standing presence and, you know, her deep knowledge in the field. So, when people hear that, they pretty much know she's someone who has been around the block, so to speak, in the investment community. It just, you know, speaks to her professional standing, in a way.

There have, apparently, been discussions about Anne Dias thinking about going back to managing outside money again. This suggests that after a period of focusing on private investments, she was, you know, considering a broader role in the market. It's, well, a pretty big decision for someone with her background, and it shows a continued interest in actively shaping investment strategies for others. This kind of talk, you know, often gets people in the finance world buzzing, because her return would be, like, a notable event, given her past achievements. So, it's, obviously, something that people pay attention to, really.

For a time, Anne Dias was, actually, one of the very few women who ran her own hedge fund. This detail is, you know, quite significant because the world of hedge funds has, traditionally, been dominated by men. Her presence as a leader in this area made her stand out and, in some respects, paved the way for others. It just goes to show, doesn't it, that she was not only successful in her field but also, you know, a pioneer in a way, breaking through barriers that existed at the time. So, her story is, obviously, more than just about investments; it's also about representation and, you know, leadership in a challenging environment, basically.

Anne Dias has also been recognized by Barron’s, which is, you know, a pretty respected publication in the finance world. She was, apparently, named one of their "100 most influential women in U.S. finance." This kind of recognition is, well, a pretty big deal. It means that her work, her insights, and her impact are seen as really important by industry observers. It’s, like, a stamp of approval, showing that she’s not just successful but also, you know, someone whose opinions and actions carry weight. So, that kind of acknowledgment, obviously, solidifies her position as a very key figure in the American financial landscape, you know, in a very real way.

What Was Anne Dias's Role at Aragon Global?

At Aragon Global Management, Anne Dias holds, you know, the titles of founder and chief executive officer. These roles mean she was the one who, like, started the company, and she's also the person in charge of its overall operations and direction. Being the CEO means she's responsible for the big picture decisions, the strategies, and making sure the company is, you know, moving in the right way. It’s, well, a position of significant authority and responsibility, obviously, and it shows that she's been at the very top of the organization from its inception. So, she's, quite literally, the person running the show, basically.

From 2001 to 2011, Anne Dias was also, apparently, the founder and managing partner of Aragon Global. The "managing partner" title, you know, often suggests a very hands-on role in the daily operations and, you know, in managing the firm's portfolio. It means she was not just setting the vision but also, like, actively involved in the nuts and bolts of the business during its early and formative years. This period was, obviously, crucial for establishing Aragon's reputation and its investment approach. So, she was, in a way, deeply embedded in the firm's core activities for a significant stretch of time, really helping to build it from the ground up.

The firm, under Anne Dias's leadership, had, apparently, a particular focus on internet investments. This means they were, like, looking at companies that were involved in the internet space, which, you know, was a pretty rapidly changing area during the time Aragon was growing. This kind of specialization suggests that Anne Dias saw the potential in digital businesses early on. It’s, well, a pretty smart move to concentrate on a sector that's experiencing significant growth, and it probably helped Aragon find good opportunities for its clients. So, her firm was, in a way, very much tuned into the evolving digital economy, basically, which is, you know, pretty forward-thinking.

What About Anne Dias's Recent Activities?

According to her LinkedIn profile, there hasn't been, you know, any recent news or activity shared there. This doesn't necessarily mean she's not active, but just that her public professional profile on that platform hasn't been updated with new announcements. It's, like, pretty common for people, especially those in private investment roles, to keep a lower profile online. So, while we might not see daily updates, it doesn't, obviously, tell us everything about what she's doing. It just means that, for now, that particular public source isn't showing any new developments, you know, in a very immediate sense.

However, there have been, apparently, discussions that Anne Dias has been thinking about making a return to money management. This suggests that even without public updates on her profile, she might be, like, considering new ventures or re-engaging with the investment world in a more active capacity. It's, well, a pretty interesting point because it shows a continued drive and, you know, a potential for her to take on new challenges in the financial sector. These kinds of discussions, you know, often happen behind the scenes before anything official is announced, so it's, obviously, something to keep an eye on, basically.

There was also, apparently, a piece of news related to Anne Dias leaving the board of Fox News in November, following questions she raised about their coverage of the January 6 insurrection. This is, you know, a pretty distinct detail from her financial career, but it shows her involvement in other public roles and, like, her willingness to speak out on matters of public interest. It's, well, a pretty significant event, given the context, and it highlights a different side of her public persona, away from just investments. So, this particular piece of information, obviously, adds another layer to her overall public profile, in a way, showing her engagement in broader societal discussions.

Were There Personal Aspects of Anne Dias's Life That Became Public?

Yes, there were, you know, definitely some personal aspects of Anne Dias's life that became quite public, particularly concerning her marriage to Kenneth Griffin. She was, as a matter of fact, his wife, and their relationship, you know, eventually led to a divorce filing. When people are as well-known as they both are in their respective fields, personal matters sometimes, like, spill into the public domain. It's, well, a pretty common occurrence for public figures, and their situation was no different. So, this part of her life, obviously, became a topic of discussion outside of just her professional achievements, basically.

Court documents related to their divorce, apparently, contained some details about their living arrangements. For instance, there was a mention that the 66th floor of their home was considered, like, an "integral part" of the residence. It was also stated that the children, Anne herself, and the household staff members, you know, regularly used that floor in their daily lives. This kind of detail, while seemingly small, became public as part of the legal proceedings. It just goes to show, doesn't it, how private spaces can become part of public record during legal disputes. So, these were, in a way, very specific insights into their family life that became widely known, you know.

There were, too, reports that Anne Dias Griffin and her then-husband, Ken Griffin, eventually, you know, reached a settlement in their divorce. This means they came to an agreement on the terms of their separation, which is, well, a pretty common outcome in such cases. Reaching a settlement often, like, brings an end to the public legal battles and allows both parties to move forward. So, while the initial filings brought some private matters into the light, the settlement, obviously, marked a resolution to that particular chapter of their lives, basically. It's, in a way, the typical end to such a public legal process, really.

In her court documents, Anne Dias, apparently, stated that Ken Griffin had shown, you know, little interest in their children, who were, as mentioned, aged 6, 4, and 2 at the time. This was, like, a very serious allegation made within the legal context of their divorce proceedings. Such statements, you know, often come up in family court cases, especially when discussing child custody or parental involvement. It's, well, a pretty sensitive topic, and it just goes to show how deeply personal details can become part of the public record when legal actions are involved. So, this was, obviously, a very personal claim that became widely known due to the public nature of the legal process, in a very direct way.

What Kind of Investment Focus Did Anne Dias's Firm Have?

Aragon Global Management, under Anne Dias’s guidance, had, you know, a pretty clear investment focus. They were, apparently, very active in global equities, which, as we touched on, means they invested in company shares from all over the world. More specifically, their attention was drawn to particular sectors. They looked at technology companies, consumer-focused businesses, and those in the financial services industry. This kind of specialized approach, you know, allows a firm to develop deep knowledge and insights within those specific markets. It’s, well, a pretty strategic way to approach investing, basically, rather than trying to cover every single industry out there, which can be, you know, quite a challenge.

Beyond just those sectors, Aragon also had, apparently, a strong interest in the internet space. This means they were, like, looking for opportunities related to online businesses and digital services. Given the rapid growth of the internet over the past couple of decades, this was, you know, a pretty forward-thinking area to concentrate on. It allowed them to tap into new trends and, you know, potentially find companies that were poised for significant expansion. So, their focus on the internet was, obviously, a key part of their investment strategy, showing a good understanding of where the economy was heading, in a very practical sense.

Furthermore, Aragon Global was, actually, active within Europe’s digital ecosystem. This includes both public companies listed on stock exchanges and private businesses that are not yet traded publicly. Their involvement in this area suggests a willingness to invest in companies at different stages of their development, from established players to newer startups. It’s, well, a pretty comprehensive approach to the digital market in Europe, indicating that Anne Dias and her team were, you know, exploring a wide range of opportunities in that region. So, they were, in a way, very much engaged with the evolving tech scene across the pond, really.

How Did Anne Dias's Firm Get Started?

Anne Dias, you know, launched Aragon Global Management back in 2001, and it got its initial push, or "seed capital," from Julian Robertson of Tiger Management. This kind of early funding from a prominent figure is, like, a really big deal for a new company. It means someone with a lot of experience and, you know, resources believed in her vision right from the start. This initial investment was, obviously, crucial for getting Aragon off the ground and giving it the financial footing it needed to begin operations. So, it was, in a way, a very strong endorsement that helped set the stage for its future growth, basically.

After its launch, Aragon, apparently, grew quite quickly and became, you know, one of the larger and more recognized asset management firms. This growth wasn't just about getting money; it was about, like, building a reputation and proving its investment capabilities. The fact that it became so well-known suggests that its strategies were effective and that it was, you know, consistently delivering results. It’s, well, a pretty impressive feat to go from a startup to a recognized name in such a competitive field. So, the firm's rapid ascent, obviously, speaks volumes about the leadership and, you know, the talent within the organization, really.

For many years, Aragon operated as a private investment office, meaning it mostly managed its own funds. But then, last year, when Anne Dias was 51, she, you know, opened up Aragon Global Management to outside investors for the very first time. This was, like, a significant shift in how the firm operated. It meant they were ready to take on capital from a broader client base, moving beyond just private funds. This decision could have been driven by a desire for further expansion or, you know, a new strategic direction for the company. So, this step was, obviously, a major milestone, marking a new chapter in Aragon's history and, in a way, changing its business model quite a bit, you know.

This article has provided a look into Anne Dias's professional journey, particularly her role as the founder and CEO of Aragon Global Management. We've explored how the firm started with seed capital from Julian Robertson and grew to become a recognized name in global equities, with a focus on technology, consumer, and financial sectors. The discussion also touched upon her standing as a "hedge fund veteran" and her recognition among influential women in finance. We also briefly covered some of her recent activities and the public aspects of her personal life, including her marriage and divorce from Kenneth Griffin. The piece aimed to offer a comprehensive, yet approachable, overview of Anne Dias's significant contributions and experiences in the financial world.

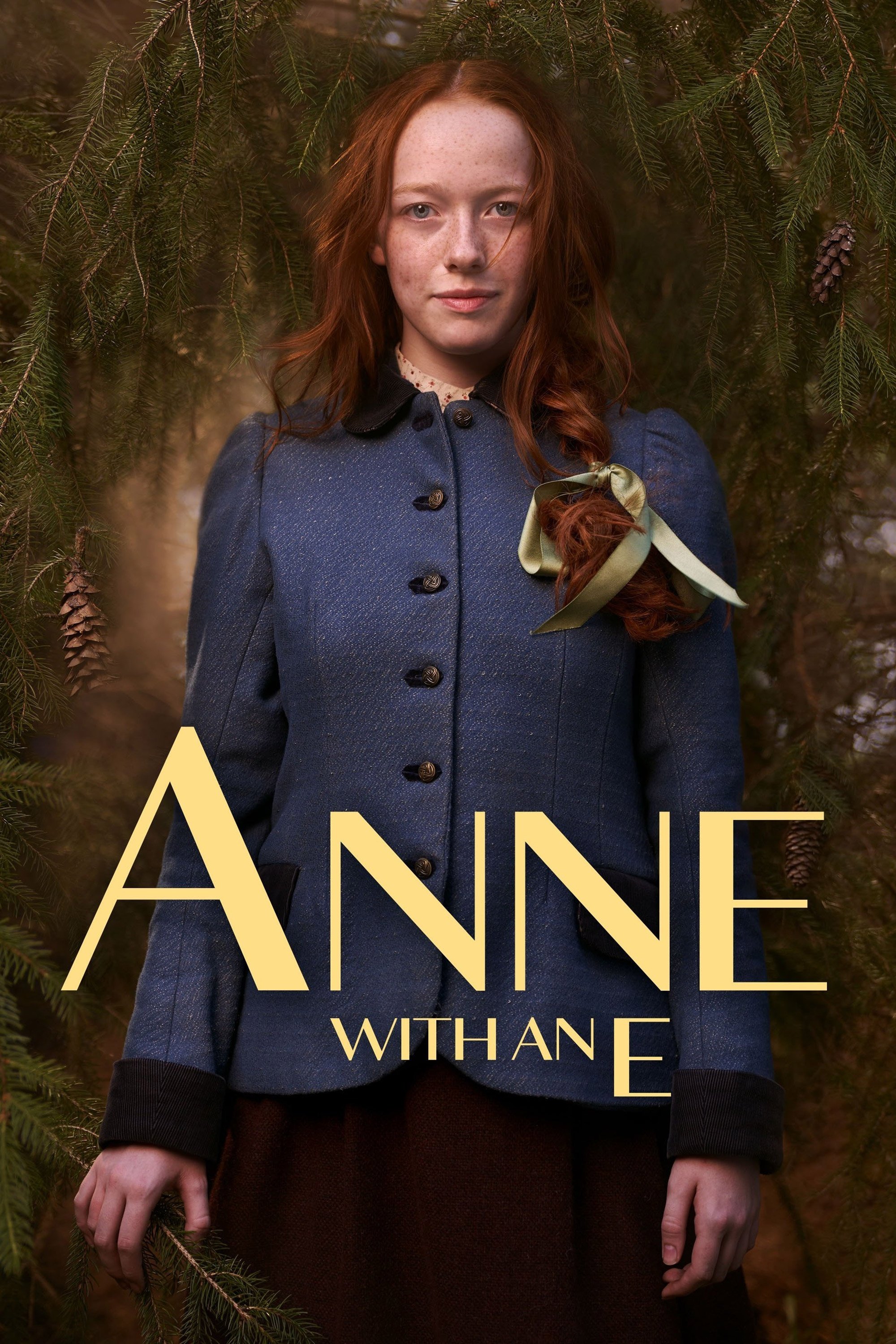

Anne With An E Onde Assistir

Anne with an E (TV Series 2017-2019) - Posters — The Movie Database (TMDB)

Anne With an E - Rotten Tomatoes