Albert - Your Financial Companion For A Brighter Future

Imagine a place where handling your money feels less like a chore and more like having a helpful friend right there with you, always ready to offer a bit of assistance. It's a common wish for many, to have a clearer picture of where their money goes and how it can grow. This feeling of wanting a simpler approach to personal finances, you know, it’s pretty universal, isn't it?

For a good many folks, that helpful companion has taken the form of a mobile application, a tool that brings together different aspects of managing personal funds into one easy-to-reach spot. It’s about making the often-complicated world of personal money management feel, well, just a little bit simpler and more approachable for everyone who uses it.

This particular application, Albert, has apparently gathered a rather substantial following, with millions of individuals choosing to use its various capabilities. It suggests, in some respects, that a lot of people are finding real value in what it offers, looking for a simpler way to keep track of their spending and saving, and perhaps even their investing, all within a single place.

Table of Contents

- What is Albert, Really?

- How Does Albert Help You Take Charge?

- Joining the Albert Family - What's It Like?

- Getting Started with Albert - A Simple Path?

- Is Albert a Bank? Clarifying the Role.

- How Does Albert See Your Whole Financial Picture?

- Smart Savings with Albert - What Can You Achieve?

- Need a Little Boost? Albert Advances.

What is Albert, Really?

So, you might be wondering, what exactly is this Albert we're talking about? Well, it's a mobile application, designed to give you a clearer view of your money. It's built around helping you get a handle on your financial situation, letting you do things like keep an eye on your spending, set aside money for future goals, and even put a bit away for longer-term growth. It's all about making those different parts of your money life work together in one place, which, you know, can be pretty convenient for many folks.

How Does Albert Help You Take Charge?

The core idea behind Albert is to give you a feeling of being in control of your personal funds. It aims to put the tools right at your fingertips so you can make more informed choices about where your money goes. This isn't just about seeing numbers; it's about feeling empowered to direct your financial future, which is that, a very important part of feeling secure in your everyday life, isn't it?

When we talk about taking charge, Albert provides avenues for a few key activities. You can, for instance, set up a budget to understand your income and outgoings better. Then there's the saving aspect, helping you put money aside, perhaps for a rainy day or a specific goal. You can also track your daily spending, which, in a way, gives you a clearer picture of your habits. And for those who are interested, there's also a component that allows for investing, giving you a chance to grow your money over time. It’s pretty much a comprehensive approach to managing money.

Joining the Albert Family - What's It Like?

It seems a great many people have already found a home with Albert. We're talking about more than ten million individuals who have decided to give this app a go, which, you know, is quite a crowd. That kind of number suggests a lot of trust and satisfaction among its users, which is that, a rather good sign for any service, wouldn't you say?

When it comes to getting started, Albert offers different ways to access its features, depending on what you might need or prefer. The plans, apparently, vary a bit in cost, running anywhere from about eleven dollars and ninety-nine cents each month to nearly thirty dollars a month. This range, in some respects, means there's likely an option that fits various budgets and needs, which is quite helpful.

And here’s a neat thing: before you commit to anything, you get a chance to try out your chosen plan for a full thirty days. This trial period, basically, gives you plenty of time to explore the features and see if Albert is a good fit for your financial habits without any immediate charge. It’s a pretty fair way to introduce people to the service, giving them a real feel for it before they decide to keep going.

Getting Started with Albert - A Simple Path?

If you're thinking about joining the millions already using Albert, the first step is actually pretty straightforward. You'll want to grab your mobile phone and head over to your device's app store. From there, you just look up "Albert" and download the application onto your phone. It’s a familiar process for anyone who uses apps regularly, so it shouldn’t take too long to get it onto your device, you know, and ready to go.

Once the app is on your phone, opening it up will prompt you to register. This part is also quite simple. You’ll be asked to provide your name, an email address, and then you’ll choose a secure password for your account. This process, in a way, makes sure your information is kept private and that only you can get into your financial details within the app, which is very important for peace of mind, really.

Is Albert a Bank? Clarifying the Role.

It’s a common question people have about financial apps: is this a bank? And for Albert, the answer is pretty clear: no, Albert is not a bank itself. This is an important distinction to make, as it helps you understand exactly what kind of service you're engaging with. It’s more of a tool to help you manage your existing financial accounts, rather than being a standalone financial institution, which is that, a good thing to be aware of.

However, while Albert isn't a bank, it does work with established banking services to provide certain features. Specifically, the banking services you might access through Albert are actually provided by Sutton Bank, which is a member of the FDIC. This means that any funds held through these banking services would have the usual protections that come with an FDIC-insured institution, offering a bit of security for your money, you know, which is always a plus.

How Does Albert See Your Whole Financial Picture?

After you’ve successfully set up your Albert account with your email and password, the next step is to link your existing financial accounts to the app. This could include your checking account, savings account, or even credit card accounts. This connection, in some respects, is what allows Albert to gather all your financial information in one spot, giving you a more complete view of your money situation, which is actually quite useful.

The main idea behind connecting all your accounts is to allow Albert to look at your entire financial picture. Instead of you having to log into multiple different bank apps or websites, Albert brings that information together. This comprehensive view, basically, helps the app give you more personalized insights and suggestions about your money, because it can see how everything fits together, which, you know, can really help you make better decisions.

Smart Savings with Albert - What Can You Achieve?

One of the really neat things Albert does is help you save money without you even having to think about it too much. It can, for example, automatically set aside funds for you, based on how much money you bring in and how much you typically spend. This kind of automated saving, in a way, takes the guesswork out of building up your reserves, making it much easier to put money away consistently, which is a pretty good feature for many.

Beyond just putting money aside, Albert also offers the chance to earn a competitive annual percentage yield, or APY, with what they call high-yield savings. This means that the money you save through the app has the potential to grow a little bit faster than it might in a traditional savings account. It’s a way to make your money work a bit harder for you, which, you know, is always a welcome thing for anyone trying to build up their savings.

And if you have specific things you’re saving for, like a down payment on a home, a vacation, or a new car, Albert lets you create custom savings goals. This means you can label your savings, making it easier to track your progress towards those particular aspirations. It helps keep you motivated, really, seeing how close you are to reaching those personal financial targets, which can be a very powerful tool for staying on track.

Need a Little Boost? Albert Advances.

Sometimes, life throws unexpected expenses our way, and you might find yourself needing a little extra cash to tide you over until your next payday. For situations like these, Albert has a feature called "Albert advances." It's designed to give you a quick financial boost when you need it most, which, you know, can be a real lifesaver for some folks when they're in a bit of a tight spot.

To get started with these advances, the process is pretty straightforward within the app. You just head over to the home screen when you’re using the application on your phone or even if you’re accessing it online. Once you're there, you'll look for and tap on something that says "instant." After that, the app will guide you through a few simple steps, or prompts, to set up your advance. It's a pretty quick way to get access to funds if you qualify, making it a handy option for those moments when you need a little financial flexibility.

This article has explored the various capabilities of the Albert financial application, from its core functions of budgeting, saving, spending, and investing, to its user base size and pricing structure. It also covered the process of creating an account, connecting financial accounts, the role of Sutton Bank in providing banking services, the automated savings features, and the availability of instant advances.

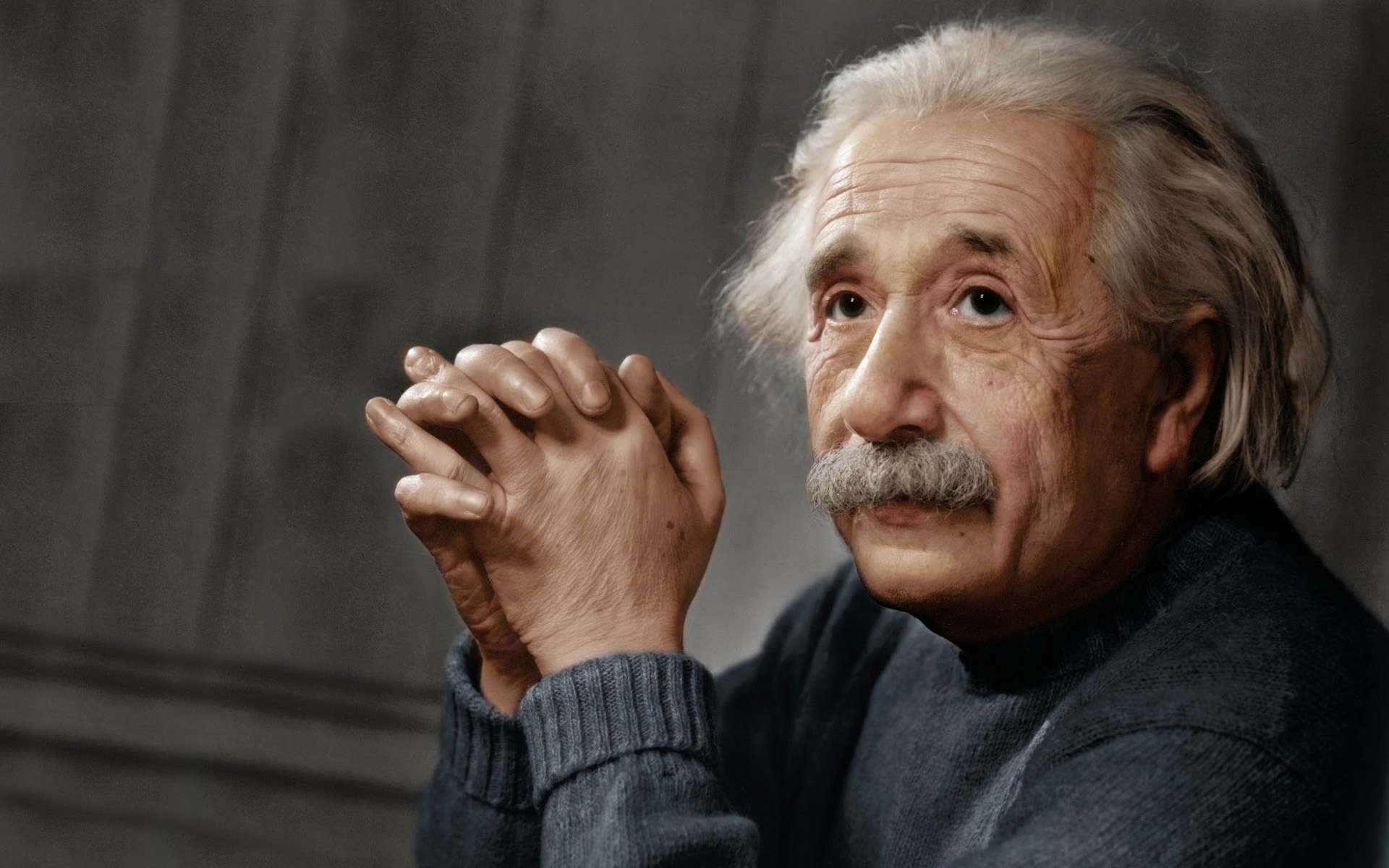

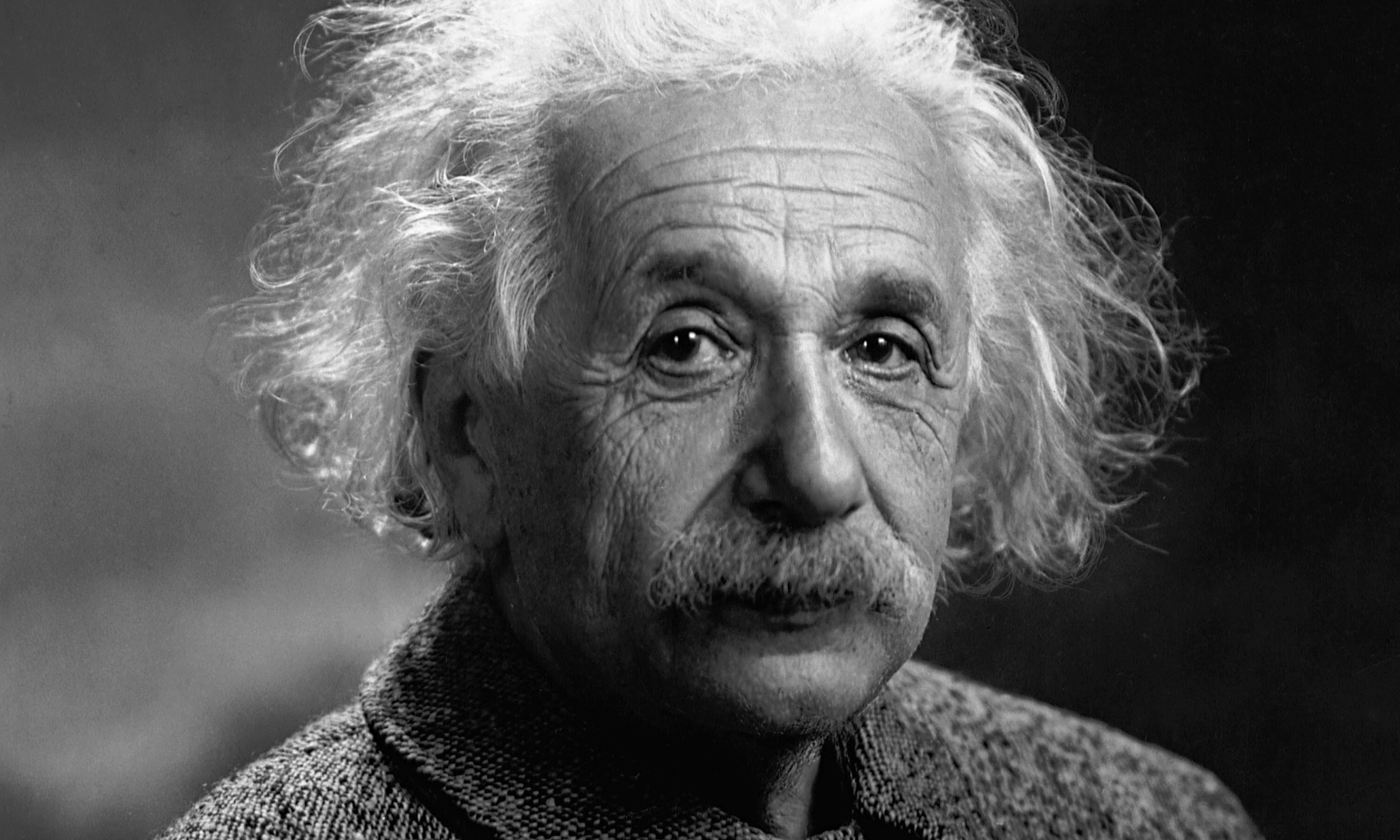

Albert Einstein Biography - Facts, Childhood, Family Life & Achievements

Albert Einstein Wallpapers Images Photos Pictures Backgrounds

Albert Einstein Wallpapers Images Photos Pictures Backgrounds